COVID-19 - Canada Emergency Response Benefit (CERB)

If you stopped working because of COVID-19, the Canada Emergency Response Benefit (CERB) may provide you with temporary income support. The CERB provides $500 a week for up to 16 weeks. Any EI applications after March 15 where the applicant is also eligible for CERB will be automatically moved over to CERB.

How to Apply: Applications started April 6 through one of two ways:

- Online through CRA MyAccount: If you set up direct deposit, CRA has said payment can be expected in 3 business days from the completion of your application. Payment by cheque can be expected to take up to 10 business days.

- 2) Telephone: 1-800-959-2019 or 1-800-959-2041 You will be required to re-attest once a month to continue receiving CERB.

More information is available at the following link: https://www.canada.ca/en/revenue-agency/services/benefits/apply-for-cerb-with-cra.html

Eligibility for CERB: The benefit will be available to workers:

- Residing in Canada, who are at least 15 years old;

- Who have stopped working because of COVID-19 and have not voluntarily quit their job;

- Did not apply for, nor receive, CERB or EI benefits from Service Canada for the same eligibility period;

- Who had income of at least $5,000 (employment income, self-employment income, or provincial/federal benefits related to maternity or paternity leave) in 2019 or in the 12 months prior to the date of their application; and

- Who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment or self-employment income.

On April 15, the government announced changes to the eligibility rules to:

- Allow people to earn up to $1,000 per month while collecting the CERB.

- Extend the CERB to seasonal workers who have exhausted their EI regular benefits and are unable to

- undertake their regular seasonal work as a result of the COVID-19 outbreak.

- Extend the CERB to workers who have recently exhausted their EI regular benefits and are unable to find a job or return to work because of COVID-19.

These changes will be retroactive to March 15, 2020. More details will be posted on the CRA portal shortly.

Please note the changes announced on April 15 have not yet been implemented, so applicants cannot consider these as criteria when applying for CERB. Until further information is provided, these are to be considered proposed changes only.

The federal government will be working with provinces and territories to cost-share a temporary top-up to the salaries of workers deemed essential in the fight against COVID-19, who make less than $2,500 a month. Details will be released shortly following further work with provinces and territories.

For those receiving dividends, you are eligible to claim CERB if the dividends are “non-eligible dividends” (generally, those paid out of corporate income taxed at the small business rate).

An individual could count this dividend income toward the $5,000 income requirement to be eligible for CERB.

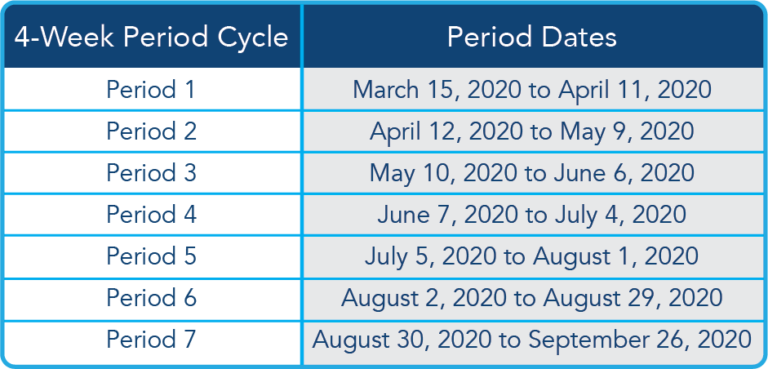

Eligibility periods are fixed in 4-week periods, and are outlined below: