COVID-19 - Canada Emergency Response Benefit (CERB)

The Canada Emergency Wage Subsidy (CEWS)

The goal is to help businesses keep and return workers to their payroll through the challenges posed by the COVID-19 pandemic. This would provide a 75 per cent wage subsidy to eligible employers for up to 12 weeks, retroactive to March 15, 2020.

Eligible Employers

Eligible employers would include individuals, taxable corporations, partnerships consisting of eligible employers, non-profit organizations and registered charities.

This subsidy would be available to eligible employers that see a drop of at least 15% of their revenue in March 2020 and 30% for the following months (see Eligible Periods). In applying for the subsidy, employers would be required to attest to the decline in revenue.

Calculating Revenues

An employer’s revenue for this purpose would be its revenue in Canada earned from arm’s-length sources. Revenue would be calculated using the employer’s normal accounting method.

Employers would be allowed to calculate their revenues under the accrual method or the cash method, but not a combination of both. Employers would select an accounting method when first applying for the CEWS and would be required to use that method for the entire duration of the program.

For registered charities and non-profit organizations, the calculation will include most forms of revenue, excluding revenues from non-arm’s length persons. These organizations would be allowed to choose whether or not to include revenue from government sources as part of the calculation. Once chosen, the same approach would have to apply throughout the program period.

Amount of Subsidy

The subsidy amount for a given employee on eligible remuneration paid for the period between March 15 and June 6, 2020 would be 75% of the amount of remuneration paid, up to a maximum benefit of $847 per week.

Employers will also be eligible for a subsidy of up to 75% of salaries and wages paid to new employees.

Eligible remuneration may include salary, wages, and other remuneration like taxable benefits. However, it does not include severance pay, or items such as stock option benefits or the personal use of a corporate vehicle.

A special rule will apply to employees that do not deal at arm’s length with the employer. The subsidy amount for such employees will be limited to the eligible remuneration paid in any pay period between March 15 and June 6, 2020, up to a maximum benefit of the lesser of $847 per week and 75% of the employee’s pre-crisis weekly remuneration. The subsidy would only be available in respect of non-arm’s length employees employed prior to March 15, 2020. There would be no overall limit on the subsidy amount that an eligible employer may claim.

Emergency Wage Subsidy Example: Bruno and Tisha run a floral shop in Winnipeg, Manitoba. They have four fulltime employees, each earning $800 per week, and 6 part-time employees, each earning $400 per week, for a total weekly payroll of $5,600. Bruno and Tisha have closed their shop and are only fulfilling online orders during this challenging period. They are keeping all of their employees on the payroll, paying them their full regular wages, despite their revenues being down by 30 per cent. Bruno and Tisha would be eligible for a weekly wage subsidy of $4,200 ($600 for each of their full-time employees and $300 for each of their part-time employees).

Eligible Periods

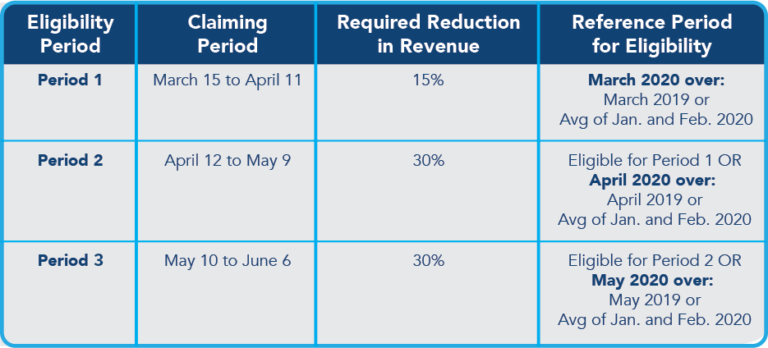

Eligibility would generally be determined by the change in an eligible employer’s monthly revenues, yearover-year, for the calendar month in which the period began.

All employers may calculate their change in revenue using an alternative benchmark to determine their eligibility. This would provide more flexibility to employers for which the general approach may not be appropriate. Under this alternative approach, employers would be allowed to compare their revenue using an average of their revenue earned in January and February 2020.

Employers would select the general year-over-year approach or the alternative approach when first applying for the CEWS and would be required to use the same approach for the entire duration of the program.

The amount of wage subsidy received by the employer in a given month would be ignored for the purpose of measuring year-over-year changes in monthly revenues.

- For example, if revenues in March 2020 were down 20% compared to March 2019, the employer would be allowed to claim the CEWS on remuneration paid between March 15 – April 11, 2020.

- Alternatively, this employer could use its average revenue from the months of January and February 2020, instead of March 2019, to determine if it is eligible for the CEWS.

- Once an approach is chosen, the employer would have to apply it throughout the program period.

The table below outlines each claiming period, the required reduction in revenue and the reference period for eligibility.

Eligible Employees

An eligible employee is an individual who is employed in Canada.

Eligibility for the CEWS of an employee’s remuneration, will be limited to employees that have not been without remuneration for more than 14 consecutive days in the eligibility period (i.e., from March 15-April 11, from April 12-May 9, and from May 10-June 6).

This rule replaces the previously announced restriction that an employer would not be eligible to claim the CEWS for remuneration paid to an employee in a week that falls within a 4-week period for which the employee is eligible for the Canadian Emergency Response Benefit.

How to Apply

Eligible employers would be able to apply for the CEWS through the Canada Revenue Agency’s My Business Account portal as well as a web-based application. Employers would have to keep records demonstrating their reduction in arm’s-length revenues and remuneration paid to employees. More details about the application process will be made available shortly.

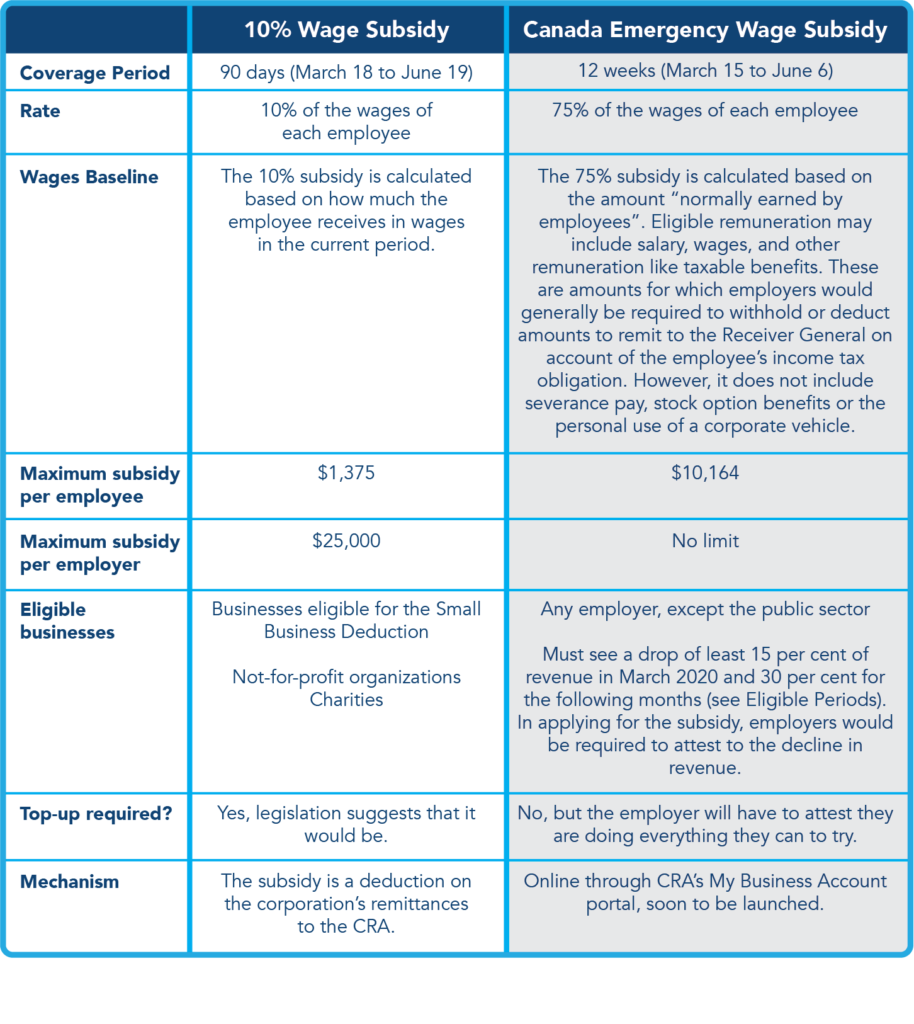

Interaction with 10% Wage Subsidy

On March 25, 2020, the COVID-19 Emergency Response Act, which included the implementation of a temporary 10% wage subsidy, received Royal Assent. For employers that are eligible for both the CEWS and the 10% wage subsidy for a period, any benefit from the 10% wage subsidy for remuneration paid in a specific period would generally reduce the amount available to be claimed under the CEWS in that same period.

Comparison of the Two Wage Subsidy Programs:

Interaction with the Work-Sharing Program

On March 18, 2020, the Prime Minister announced an extension of the maximum duration of the Work-Sharing program from 38 weeks to 76 weeks for employers affected by COVID-19. This measure will provide income support to employees eligible for Employment Insurance who agree to reduce their normal working hours because of developments beyond the control of their employers.

For employers and employees that are participating in a Work-Sharing program, EI benefits received by employees through the Work-Sharing program will reduce the benefit that their employer is entitled to receive under the CEWS.

Ensuring Compliance

Employers will be required to repay amounts paid under the CEWS if they do not meet the eligibility requirements. Penalties may apply in cases of fraudulent claims. The penalties may include fines or even imprisonment. In addition, anti-abuse rules would be put in place to ensure that the subsidy is not inappropriately obtained and to help ensure that employees are paid the amounts they are owed.

Employers that engage in artificial transactions to reduce revenue for the purpose of claiming the CEWS would be subject to a penalty equal to 25% of the value of the subsidy claimed, in addition to the requirement to repay in full the subsidy that was improperly claimed.

Government Assistance

The usual treatment of tax credits and other benefits provided by the government would apply. As a consequence, the wage subsidy received by an employer would be considered government assistance and be included in the employer’s taxable income.

Assistance received under either wage subsidy would reduce the amount of remuneration expenses eligible for other federal tax credits calculated on the same remuneration.

Refund for Certain Payroll Contributions

The Government is proposing to expand the CEWS by introducing a new 100 per cent refund for certain employer-paid contributions to Employment Insurance, the Canada Pension Plan, the Quebec Pension Plan, and the Quebec Parental Insurance Plan. This refund would cover 100 per cent of employer-paid contributions for eligible employees for each week throughout which those employees are on leave with pay and for which the employer is eligible to claim for the CEWS for those employees.

In general, an employee will be considered to be on leave with pay throughout a week if that employee is remunerated by the employer for that week but does not perform any work for the employer in that week. This refund would not be available for eligible employees that are on leave with pay for only a portion of a week.

This refund would not be subject to the weekly maximum benefit per employee of $847 that an eligible employer may claim in respect of the CEWS. There would be no overall limit on the refund amount that an eligible employer may claim.

For greater certainty, employers would be required to continue to collect and remit employer and employee contributions to each program as usual. Eligible employers would apply for a refund, as described above, at the same time that they apply for the CEWS.