COVID-19 - Canada Emergency Response Benefit (CERB)

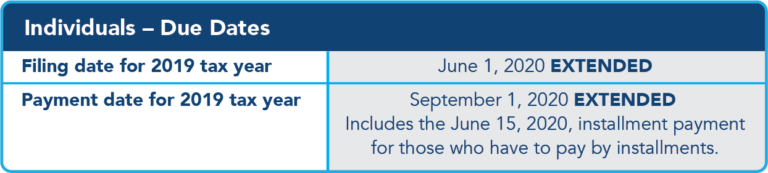

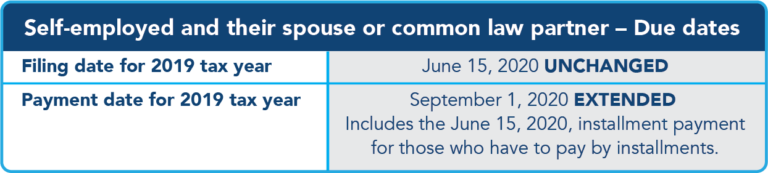

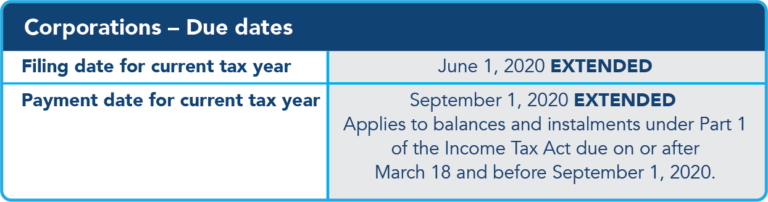

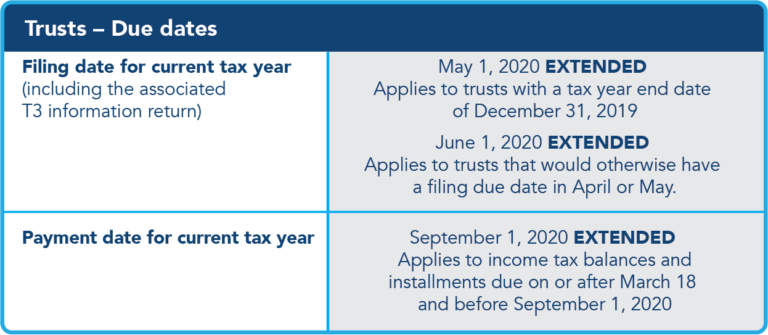

CRA Deferrals - Income Tax Filing & Payment

Deferral of GST Sales Tax Remittance

Deferral of Goods and Services Tax/Harmonized Sales Tax (GST/HST) remittances and customs duty payments to June 30, 2020. CRA will extend until June 30, 2020 the time that:

• Monthly filers have to remit amounts collected for the February, March and April 2020 reporting periods;

• Quarterly filers have to remit amounts collected for the January 1, 2020 through March 31, 2020 reporting period; and

• Annual filers, whose GST/HST return or instalment are due in March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

Deferral of Customs Duty and Sales Tax for Importers

Imported goods by businesses are generally subject to the GST, at a rate of 5 per cent, as well as applicable customs duties, which vary by product and country of origin. While most imports enter Canada duty-free, some tariffs remain, especially on consumer goods.

Payment deadlines for statements of accounts for March, April, and May are being deferred to June 30, 2020.

CRA Administrative Measures

- Collections activities on new debts suspended until further notice, and flexible payment arrangements will be made available.

- CRA will generally not contact SME businesses to initiate any post assessment GST/HST or income tax audits until further notice, and interaction with taxpayers will be limited to high risk and exceptional cases.

- Objections related to Canadians’ entitlement to benefits and credits have been identified as a critical service and should not experience any delays.

- For objections related to other tax matters filed by individuals and businesses, the CRA is currently holding these accounts in abeyance. No collection action will be taken with respect to these accounts at this time.

- For objections that are due March 18, 2020 or later, CRA is are effectively extending the deadline to June 30, 2020.

- Appeals before the Tax Court of Canada (TCC) have been ordered an extension of all timelines. More information can be obtained directly from TCC.

- Taxpayers unable to file a return or make a payment by the tax-filing and payment deadlines because of COVID-19 can request the cancellation of penalty and interest charged to their account. Penalties and interest will not be charged if the new deadlines that the government has announced to tax-filing and payments are met.